An often neglected yet important financial product, critical illness coverage has often been misunderstood, mis-sold and confused with health insurance. To better understand the need for this insurance, let’s look back in time to see how the concept came about. Contrary to what you would expect, critical illness coverage wasn’t conceived by a financial company but by a doctor. Dr. Marius Barnard founded critical illness insurance in 1982 when he discovered that his patients were not recovering well from major illnesses due to the mental strain from ensuing financial hardships. Interestingly, most of these patients had health insurance. The source of the stress was often the other incidental financial impacts of critical illnesses.

In this article, we delve deeper into some of these potential financial impacts and how critical illness coverage can mitigate them in the unfortunate scenario of a major illness.

What is critical illness coverage?

A critical illness coverage, often referred to as dread disease policy, is a contract with an insurer to make a lump sum pay-out when the insured gets diagnosed with one of the specific illnesses on a predetermined list. Some of the common illnesses typically covered include:

- Heart attack

- Stroke

- Cancers

- Organ transplant

- Coronary bypass

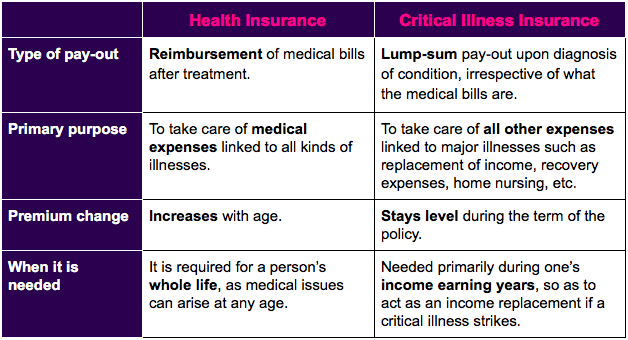

Critical illness is not a replacement of health insurance, but instead something to compliment it. Getting health insurance is the first step to protecting yourself and your loved ones against the financial impact of diseases (read our blog post) while critical illness insurance is the advanced step to strengthening your financial protection shield. The pay-out for critical illness coverage can be used to cover not just the medical expenses but also other incidental expenses due to the illness. Let us see the key differences between health insurance and critical illness insurance.

How is it different from health insurance?

Health Insurance

Critical Illness Insurance

Type of pay-out

Reimbursement of medical bills after treatment.

Lump-sum pay-out upon diagnosis of condition, irrespective of what the medical bills are.

Primary purpose

To take care of medical expenses linked to all kinds of illnesses.

To take care of all other expenses linked to major illnesses such as replacement of income, recovery expenses, home nursing, etc.

Premium change

Increases with age.

Stays level during the term of the policy.

When it is needed

It is required for a person’s whole life, as medical issues can arise at any age.

Needed primarily during one’s income earning years, so as to act as an income replacement if a critical illness strikes.

Why do I need it?

The not so obvious financial impacts of critical illnesses

If someone gets diagnosed by a major illness, we can often foresee the high medical costs that would be incurred. However, there are a host of other financial impacts on one’s life and family which can create extreme financial stress and affect the patient’s recovery.

The pay-out from critical illness insurance can be used to cover major expenses, such as:

- To replace any lost income and sustain the family’s lifestyle needs such as rent payment, electricity bill, food expenses, loan repayments, etc, in the case that the breadwinner of the family is diagnosed with a major illness and is unable to continue working

- To pay for medical expenses which might not be payable by health insurance such as home nursing help, additional helpers, alternative medicine, etc.

- To pay for specialized treatment which might not be covered by health insurance. For example, overseas travel and stay to get specialized treatment for certain conditions which might not be available or as advanced in your home country.

- To pay for other increased expenses including transportation to the medical facilities, vehicle or home modifications such as installing lifts at the patients home, etc.

- For terminally ill patients to plan a vacation with family or move to a peaceful place to live out the remaining life.

Higher prevalence of major illnesses due to lifestyle changes

According to the GOQii India Fit Report of 2020, lifestyle related issues such as diabetes, hypertension and thyroid are on the rise. More than 62% of participants in the research were in the borderline or high risk zone. These lifestyle changes have been shown to have direct links to major critical illnesses such as heart attacks and strokes, making critical illness coverage more important today than ever before.

Role Of Critical Illness Insurance In Your Financial Planning

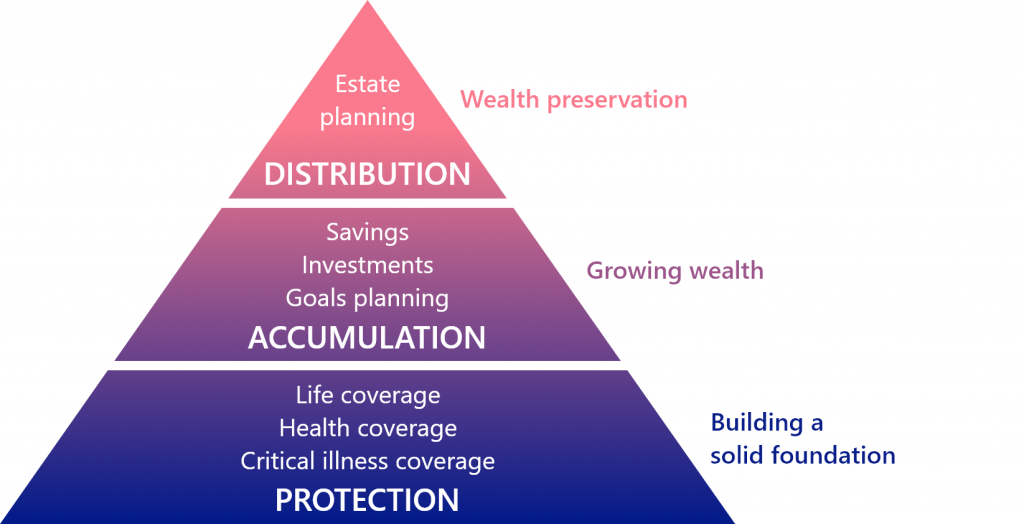

The Financial Needs Hierarchy Pyramid demonstrates the critical role of financial protection in your overall financial planning and goals. It is important to build a solid foundation by insuring yourself for emergencies before you proceed to the higher levels of growing your wealth and building your legacy. No matter how much you save and invest, if you haven’t managed the financial risks with the appropriate insurance solutions, it could all come crashing down like a house of cards. Critical illness insurance is one of the key risk management tools to protect yourself from the impact of major illnesses.

Financial Needs Hierarchy Pyramid

Bottom Line

If you have been lucky, you have probably not had to make any critical illness claim or even heard about it in the first place. But like the saying goes, while we hope for the best, we should prepare ourselves for the worst. The incidental expenses of major illnesses can be significant, which makes major illnesses one of the leading causes of bankruptcies globally despite many of these families having health insurance. The overall stress impacts one’s mental well-being which has been proven to affect recovery, compounding the issue.

Take action now and protect yourself and your loved ones from the potential impacts of such eventualities.