Key Takeaways

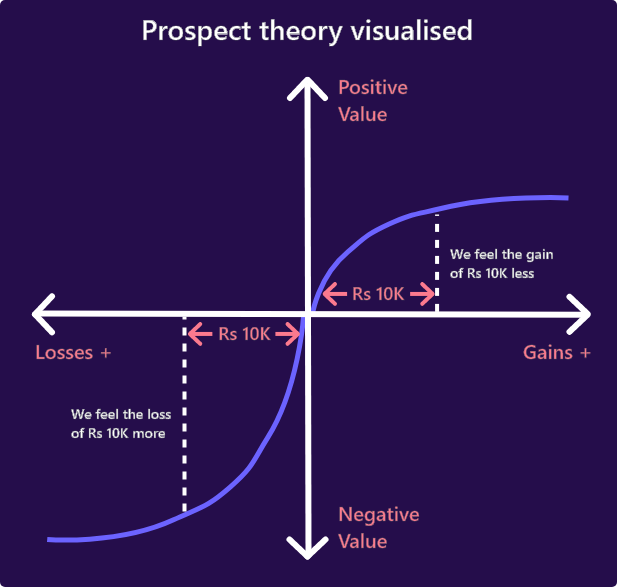

- For the same amount of gains and losses, we associate a much larger reduction in value for the loss as compared to the increase in value from an equal amount of gain.

- As a result of this skewed perception of losses as being extremely negative, we end up choosing safer investment options with little or no risk such as fixed deposits or saving schemes.

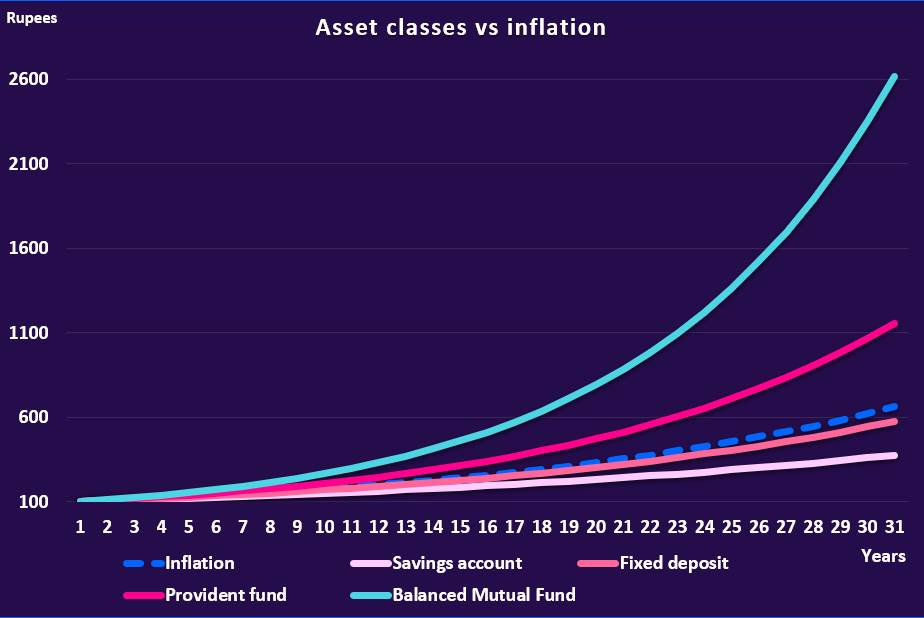

- The extreme aversion to high return instruments can have a significant impact on one’s net worth in the long run as their real inflation adjusted returns are actually negligible.

- You should create a diversified portfolio comprising varying percentages of stocks, bonds, property, gold, etc. to ensure you are in the best position to make money while minimising your risks.

India is facing a problem: the problem of risk aversion. This might be the single greatest obstacle to people getting rich and making their dreams come true. You might say that risk tolerance is inherent to an individual, shaped by experiences and intrinsic ability to take risks. Although that is partly true, there are a couple of other factors at play, making us more risk averse than we should be as rational individuals. One of the reasons often cited is a lack of knowledge of how financial markets and investments work. Understanding how everything works demystifies finance, thereby reducing the degree of risk aversion.

Unfortunately, information alone does not determine one’s level of risk aversion. Had that been the case, we would not see so many educated and financially informed individuals making the same mistake. This happens because there is a bigger factor at play here: we are only human. And no, we are not being philosophical. The propensity to be risk averse is literally embedded in human emotions and a deeply rooted psychological anomaly we all suffer from. In this blog post, we unwind what this anomaly is from the lens of the Prospect Theory.

What is prospect theory?

Prospect theory postulates that we incorrectly perceive the value of gains and losses. For the same amount of gains and losses, we associate a much larger amount of reduction in value for the loss as compared to the increase in value from the gain. If an individual gains Rs 10,000 vs loses Rs 10,000, they tend to associate the loss with a lot more pain as compared to the joy from the gain. As rational individuals, we should perceive equivalent gains and losses with the same proportion of positive and negative emotion, but we do not. This is the root cause of the risk aversion problem.

How does this manifest in our investment choices?

As a result of the skewed perception of losses as being extremely negative, we end up choosing safer investment options with little or no risk. Some of the options people often go for would be fixed deposits, savings schemes (such as PPF and post office schemes) and endowment plans. High return options such as stocks are considered a ‘gamble’ by a large proportion of the population.

The extreme aversion to high return instruments can have significant impacts on one’s net worth in the long run as their real inflation adjusted returns are actually negligible. (Find out about how the different investment options compare with each other in our article on the impact of inflation.)

What should you actually be doing with your investments?

Do not get us wrong, we are not vilifying risk-free investments. We are simply highlighting that an overconcentration of these investment types in your portfolio is not the best idea for your financial health. These types of no-risk investments are great solutions for your emergency funds and short term goals (< 3 years). However, you do not necessarily need to take a capital guaranteed approach for growing your wealth and meeting your longer term goals.

The keyword here is diversification. You should still adopt a portfolio strategy that suits your risk profile, however make sure that it is not stemming from psychological biases and completely skewed to one end. Instead, you should create a diversified portfolio comprising varying percentages of stocks, bonds, property, gold, etc. – the relative proportions of which can be determined by your risk preference. This would put you in the best position to make money while minimising your risks.

Bottom Line

Fear has been one of our greatest friend from an evolutionary point of view. However, disproportionate overestimation of fear can be detrimental for our bank balance in the long run. Try to get over this fear with regards to your investments. We will be coming up with intuitive tools to help you in your journey in the near future. Stay tuned!