“Everything is so expensive now. When I was younger, a chocolate bar would cost only a few paise”. We have all heard our parents or grandparents say this at some point. How does a chocolate bar that cost a few paise 40 years ago cost Rs 10 today? The answer is simple – inflation.

What is inflation?

Inflation is the rate at which the average price of goods and services increase in an economy over a period of time. This reduces the purchasing power of the currency over time. This affects everything from the price of a movie ticket to your car to college education.

How does inflation impact your savings?

Let us take Raj for example, who has been saving up to buy his dream car. The cost of the car in the year 2010 was Rs 10,00,000. He calculated that if he saves Rs 1,00,000 every year for 10 years, he will have enough to buy it. He opened a savings account with his bank to deposit the funds needed for his purchase. His savings account was giving him an interest of 4.5% per annum on average, to provide him with a buffer to achieve his goal.

However, Raj failed to factor in inflation which averaged 6.5% for the automobile industry. Come 2020, Raj was excited thinking he had exceeded his saving targets but was soon disappointed to find out that the cost of the car had increased. By the year 2020:

- Raj’s savings had grown to Rs 12,28,820

- The car’s price had increased to Rs 18,77,137

This is how significant the impact of inflation is! We as a culture have always been savers. It is the first important step to achieving our financial dreams. However, saving on its own is not enough to protect our goals from the impact of inflation over time.

How can you protect against the impact of inflation?

Protecting your savings from the impact of inflation is easier than you may think – invest in solutions that outperform the rate of inflation.

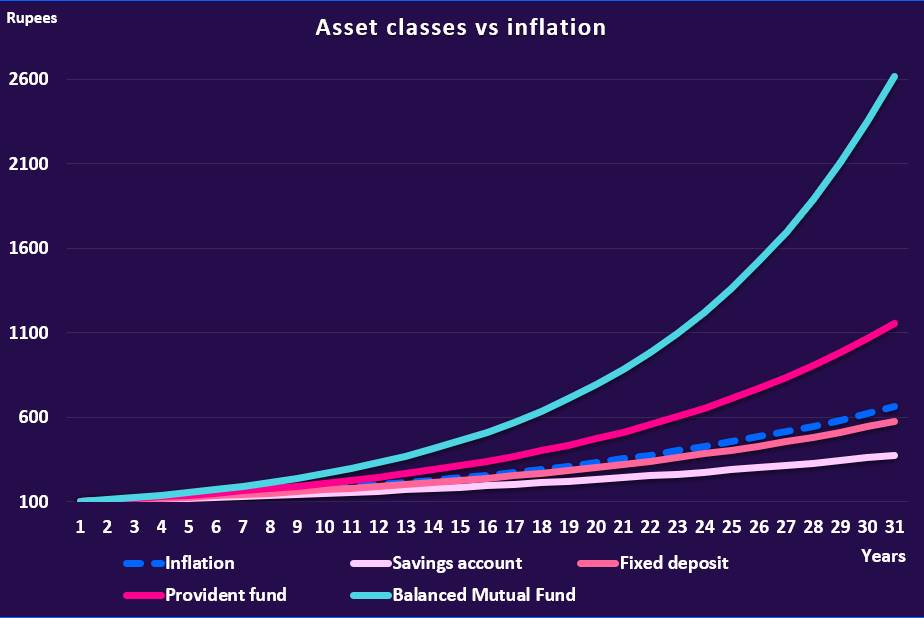

Some of the most popular investment tools in India are fixed deposits (FD) and provident fund (PF). If you have invested in either of these, you have taken a step in the right direction as compared to keeping all your funds in a savings account. However, the average rate of return from FDs merely matches the rate of inflation while PF outperforms inflation only marginally. So what you are doing is avoiding your savings from eroding away due to inflation.

However, if you want to grow your wealth, you need your investments to not just match inflation but outperform it considerably. Stock investments are a good option but involve risks and require knowledge with regards to stock picking. Better solutions might be Mutual funds (MF) and Exchange traded funds (ETF) which help with the diversification of risks, yet comfortably outperform inflation over the years. There is also an option of adding fixed income instruments like Bonds and Real estate investment trusts (REIT) to your portfolio to further reduce the risks.

To put things in perspective, the graph below shows how Rs 100 invested in the different asset classes grows over a period of 30 years in comparison to inflation.

Bottom Line

Inflation can severely compromise our ability to meet our goals in the long term by reducing the purchasing power of our savings. Fortunately, investing is a way of preserving and enhancing the purchasing power of our funds. It is critical to understand your options and choose your investments wisely in order to not just counteract the effect of inflation but to leverage the opportunity to grow your wealth.