Key Takeaways

- Tax deductions are reductions in the tax amount that a person has to pay by reducing the taxable income of an individual.

- Tax deductions under section 80D include health insurance premiums and other healthcare costs such as preventive health check-up payments made for self, spouse, dependent kids and parents.

- The maximum deduction for health insurance premiums paid for self and immediate family, as well as for parents is Rs 25,000 for each category for those aged 60 years and below and Rs 50,000 for those above 60 years of age.

- The maximum deduction for health check-ups is Rs 5,000 for self, immediate family and parents. This amount cannot exceed the overall limits of Rs 25,000 and Rs 50,000 as applicable for health insurance premiums.

Getting health coverage is one of the most critical steps to financial planning and a must have for one and all. We have delved into the numerous benefits of health insurance – such as protecting your savings from unforeseen healthcare costs and ensuring a faster recovery by reducing mental stress – in our posts on why you should get it and what you need to understand about it. And while these are undeniable and indispensable benefits of health coverage when an unforeseen health emergency comes about, there is the added bonus of short-term monetary benefits that you can reap as well in the form of tax savings.

What are tax deductions?

Tax deductions are reductions in the payable tax amount, made possible by lowering the taxable income of an individual through actions such as investing for one’s future, buying insurance or funding education among others. This has been designed to incentivise individuals to focus on personal financial planning, where they may otherwise be falling behind in. In essence, tax deductions give taxpayers the much needed push to plan for retirement, financially protect themselves and/or save for their goals.

Section 80D of the Income Tax Act covers the provision of tax deductions related to health insurance and other healthcare costs.

What are the most common items covered under 80D tax deductions?

1) Health insurance premiums for self and immediate family

Health insurance premiums paid for immediate family, that is, spouse and dependent children, through a non-cash method (e.g. cheque, bank transfer, credit card, etc.) are applicable for tax deduction under Section 80D. The combined deduction that can be claimed for this benefit is Rs 25,000. However, if you or your spouse are senior citizens, this benefit can go upto Rs 50,000.

2) Health insurance premiums for parents

You can also get tax deductions on health insurance premiums paid for parents through non-cash (e.g. cheque, bank transfer, credit card, etc.) methods.The maximum limit to this deduction is Rs 25,000 for parents below the age 60 and Rs 50,000 for parents above the age of 60.

3) Preventive health check-ups

Costs for preventive health check-ups are tax deductible upto Rs 5,000 for self, spouse, dependent kids, and parents. These expenses can be paid for in cash as well. However, it must be noted that the cap of Rs 5,000 forms a subset of the overall limits for health insurance premiums (Rs 25,000 or Rs 50,000). This means if the health insurance premiums for self and immediate family exceed Rs 25,000, no further deductions under preventive health check-ups can be availed. So the amount that can be claimed under this category is equivalent to the difference between your overall limits and health insurance premium charges, capped at Rs 5,000.

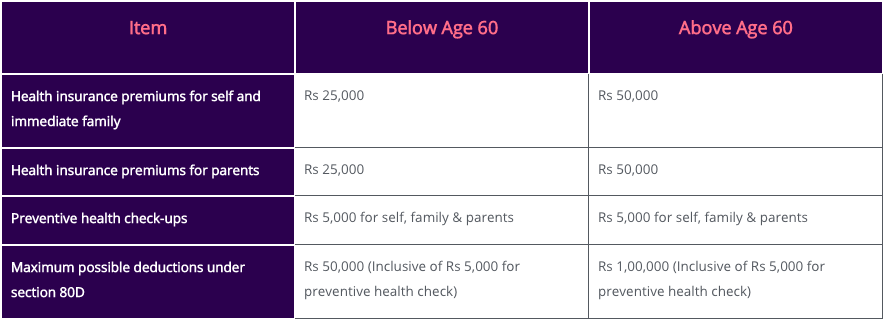

Maximum deductions under section 80D

Item

Below Age 60

Above Age 60

Health insurance premiums for self and immediate family

Rs 25,000

Rs 50,000

Health insurance premiums for parents

Rs 25,000

Rs 50,000

Preventive health check-ups

Rs 5,000 for self, family & parents

Rs 5,000 for self, family & parents

Maximum possible deductions under section 80D

Rs 50,000 (Inclusive of Rs 5,000 for preventive health check)

Rs 1,00,000 (Inclusive of Rs 5,000 for preventive health check)

Bottom Line

Tax deductions have been designed to get you to take the right steps with your finances. Even without these incentives, you must realise that you should get appropriate amounts of health insurance coverage for yourself and your family to protect your savings from the potential impact of health issues. That should be the key takeaway, with the tax savings as an added bonus.