Key Takeaways

- Loans can help you achieve your goals faster, leave you financially better off and even help you make money if used wisely.

- Home loans help you save on rental cost, buy a home faster and create an asset in the process.

- Education loans can help you complete your degree faster and enhance your income earning potential to eventually leave you financially better off.

- Business loans have several uses ranging from leverage, cash flow assistance and investing in key projects for a company among others.

Should you take loans? The intuitive answer to this question sounds like a resounding no. You would rather save and invest to achieve your goals and keep compound interest on your side. One would think it’s obviously better to earn interest rather than pay interest, isn’t it? This approach would be oversimplifying the concept of debt.

In certain situations, loans actually help to make money and get to your goals faster. Of course, the type of loan in question is an important factor in determining how you make your decision on whether to borrow or not. It is simpler to decide in case of loans that are considered “good debt” such as home loan, business loan or education loan. We have analyzed the types of loans with respect to the benefit you derive in our post on good and bad debt.

For those wondering “Loan is still borrowed money, how does it help me?”, let’s explore how borrowing money in certain situations can work in your favor.

Situation where loans are your friend

Home loans

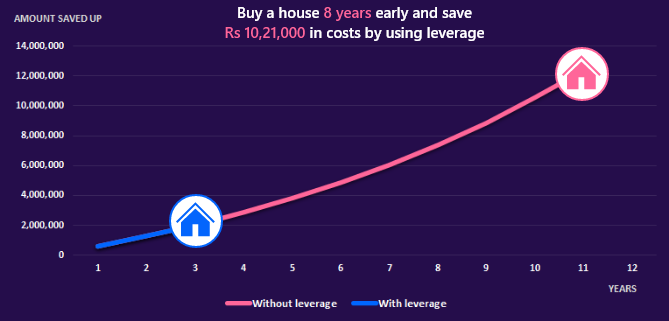

Home loans open up the possibility of buying a house earlier, thereby improving your quality of life, and simultaneously leaving you better off financially. Let us look at an example to understand this.

Priya, a young working professional, wants to buy her first home. She has been currently renting an apartment and paying Rs 65,000 in rent per month. She has also been diligently saving Rs 50,000 every month and investing it in a balanced portfolio of mutual funds getting a return of 8% consistently. She has two options now:

- Buy without mortgage:

- Amount required to fund full purchase: Rs 1,00,00,000

- Time needed to save this amount: 11 years

- Buy with mortgage:

- Amount needed for down payment: Rs 20,00,000 (Rs 80,00,000 will be loaned to her by the bank at an interest rate of 6.5% per annum)

- Time needed to save this amount: 3 years

Getting a mortgage enabled Priya to buy her house 8 years earlier than she would be able to otherwise. This means that had she chosen to pay for her house in full, she would have to pay rent for an extra 8 years which amount to Rs 62,40,000 (assuming she stays independently). However, with the help of a mortgage, she could move into her own home and pay her interest cost of Rs 52,19,000. As a result, she would save Rs 10,21,000 in pure costs (rent or interest cost). Not only is she better off financially but also bought her house in 1/4th of the time it would take otherwise. A complete no brainer!

Education loan

Similarly, the case to borrow can be a compelling one for education. If you don’t take an education loan, you might have to delay your university. With the logical assumption that your income will increase after your degree, it might make sense to pay the education loan interest as it will be more than compensated for by the higher salary (in most cases, you need to be pragmatic while selecting your course and school). You would also not want to sacrifice on your early career building years by delaying going to university as these missed opportunities, although harder to quantify, can have a much bigger impact on your life.

Business loan

For a business, delaying certain critical projects or enhancements can be the difference between failure and success. Say you have a great business idea, and the time is just perfect for this opportunity. Due to lack of capital, if you don’t do this now, someone else might do it before you. In a different situation, it could be meeting a business need, something as simple as a short-term cash requirement needed to deliver your product or service to the customer and get paid in return. The concept of “leverage” is of incredible importance to any business in order to ensure they can invest adequately in opportunities and strengthen their returns. This can be demonstrated with a simple example.

Company A has a great investment opportunity in its sight. With the investment made, it expects a 200% return on the investment in a 1 year timeframe. It has Rs 2,00,00,000 in cash that it can set aside for this investment. The company has two choices:

- Invest without leverage:

- Invest the cash at hand without any borrowing: Rs 2,00,00,000

- Cash at the end of the project: Rs 4,00,00,000

- Returns: Rs 2,00,00,000 (100% of the cash invested directly by the company)

- Invest with leverage:

- Total investment with leverage: Rs 4,00,00,000 (Rs 2,00,00,000 invested from company’s cash and Rs 2,00,00,000 borrowed from the bank)

- Cash at the end of the project: Rs 8,00,00,000

- Amount to be paid to the bank: Rs 2,20,00,000 (including 10% interest per annum)

- Amount left with the company: Rs 5,80,00,000

- Returns: Rs 3,80,00,000 (190% of the cash invested directly by the company)

The final returns to the company almost doubled in the case of leverage vs without leverage! If used smartly, leverage can enable faster growth and generate superior returns. However, it should only be used in situations where there is a high conviction in good returns.

Bottom Line

Numbers always speak louder than words. They have proven that loans, if used well, can be a powerful tool. Use leverage smartly to get to your goals faster and be better off financially.

To guide you better, we are coming up with smart digital tools to help you in your journey in the coming months. Stay tuned!