Consumer debt to GDP ratio in India is only 13% as compared to 80% in the US, which means that fewer people are borrowing. Essentially, the wealth is sitting underutilised in the banks, available to only a select few, which is mostly the high net worth individuals or big corporations. Efforts need to be channeled into increasing spending ability for individuals in all income groups, and for businesses of all sizes by providing greater access to funds by means of various loans. We are seeing encouraging signs from India’s millennial population, which surpasses 400 million people. Data suggests that over the past few years, borrowing has increased amongst this group, supported by digitisation and greater accessibility of banking services.

So, is that a good sign? Not necessarily. While it does indicate a growing economy, the type of debt plays a significant role in the financial health of individuals as well as the economy. The disconcerting fact is that the increased borrowing is largely in the form of short term personal and credit card debt, primarily used to fund lifestyle needs. Such loans can be detrimental to our finances. So where do we find the line between utilisation of money and bad credit? Let’s look into debt in detail to find out.

What is debt?

Debt is the amount of money borrowed by one party from another. There is a condition to pay this amount back at a later date, usually with interest.

In effect, when you take a loan, you are borrowing from your future self. There are a few factors that determine whether it is a “good” or a “bad” debt, the most critical considerations being – the purpose of the loan and the cost of borrowing (or interest).

Good debt vs bad debt

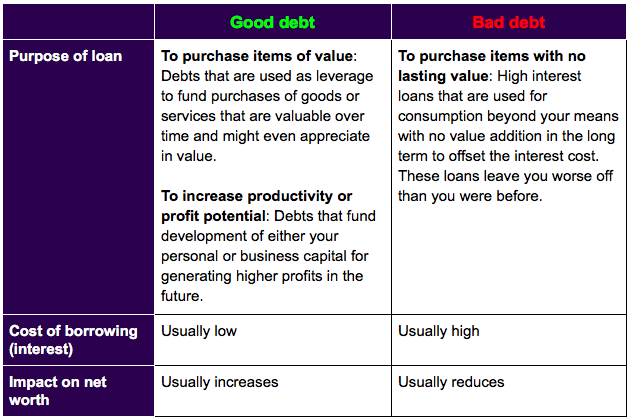

The key characteristics of good and bad debt can be compared as below:

Good debt

Bad debt

Purpose of loan

To purchase items of value: Debts that are used as leverage to fund purchases of goods or services that are valuable over time and might even appreciate in value.

To increase productivity or profit potential: Debts that fund development of either your personal or business capital for generating higher profits in the future.

To purchase items with no lasting value: High interest loans that are used for consumption beyond your means with no value addition in the long term to offset the interest cost. These loans leave you worse off than you were before.

Cost of borrowing (interest)

Usually low

Usually high

Impact on net worth

Usually increases

Usually reduces

Let’s look at some of the common types of loans, how we can classify them, and the factors and exceptions to take note of.

Home loan

Good debt

Your home increases in value over time and offsets the interest cost you pay. This interest is on the lower side as compared to other unsecured loans, since your house acts as collateral to the loan. One of the key considerations for home loans is whether it is for a residential property or investment property. If it’s your primary residence, you want to pay up sooner rather than later for peace of mind. Refinancing your mortgage can help reduce your loan term and save on interest costs.

Business / Investment loan

Good debt

This works on the concept of leverage as you can increase your business or investment capital in value by taking this loan. As long as your expected business or investment returns are higher than the loan’s interest rate, you stand to benefit from this loan type. That said, you should be mindful that business loans increase liabilities of a company and may put pressure on future cash flow. If not managed properly, it may lead to unsustainable repayment.

Education loan

Good debt

This is an example of a loan where you fund your own development in order to increase your income earning potential as well as loan repayment capability. In that vein, it is important to ensure that the amount of loan you are taking can be compensated adequately with your future career prospects and repayment capability.

Automobile / Car loan

Usually Bad debt

A car or bike purchase has no lasting value and depreciates over time, eventually becoming a sunk cost. This is why automobile loans are often categorised as bad debts, especially when used to fund a purchase beyond your means. However, auto loans can be considered good debt in certain situations such as if it’s your first vehicle and is bringing you utility by helping you get to work, school etc. or bringing specific benefits in terms of business productivity. What needs to be carefully considered is whether the loan repayment amount is within your monthly payment ability and if there is a significant benefit in not paying cash upfront.

Credit card loan

Bad debt

This is one of the riskiest loan types, which is often used to undertake purchases beyond your means such as funding a luxury trip. It tends to make people lose track of expenses and eventually consume more than they can pay off. That said, credit cards are good as means of payments so long as the bills are paid on time, helping to build your credit score and putting you in an advantageous position to get loans in the future.

Personal loan

Bad debt

Another example of a high interest loan often used to fund huge expenses is personal loan. It is a sunk cost which can’t be recouped. If at all one must borrow to pay off urgent unexpected expenses, it must be paid off as soon as possible, by always prioritising these payments and looking for refinancing options to reduce interest cost where possible.

How bad can bad debt be?

Raj took a 10-day leisure trip to Europe costing Rs 2,50,000 – an amount he could not pay in lump sum cash. He thus funded his trip with a credit card loan with plans of paying it off in monthly installments of Rs 10,000. However, Raj failed to factor in the high interest rate charged by his credit card provider. It was almost 40% per annum!

Here is what happened:

- Trip cost: Rs 2,50,000

- EMI: Rs 10,000

- Total interest cost: Rs 296,490

- Total amount paid: Rs 5,46,490

Raj ended up spending more than double for his trip and it took him almost 5 years to pay his loan back. It would have been financially prudent to opt for a less expensive trip or wait for a while to build up his savings to self-fund the Europe trip.

Bottom Line

Loans often have a negative connotation attached to them, however they are one of the most important tools to realise your dreams and in fact, grow your wealth faster. However, when used for immediate gratification and unproductive consumption, without being conscientious of repayment liabilities, debt can lead to situations of extreme financial hardships. At every juncture, while considering a loan, always see the overall impact on your net worth in the long run, before deciding whether or not to proceed with it.