Key Takeaways

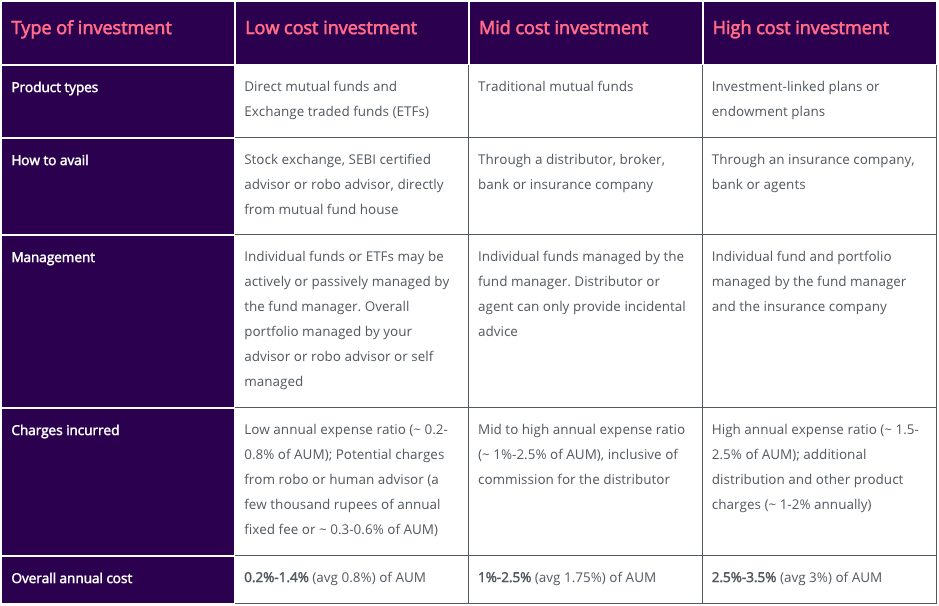

- You have a choice between low cost (direct mutual funds & ETFs), mid cost (traditional mutual funds) and high cost (insurance or endowment products) investments to get access to managed solutions.

- Based on the numbers, you would be significantly better off choosing the low cost options.

- You pay high commissions for traditional mutual funds, with practically no differences from traditional mutual funds.

- Capital guarantees and lumping of insurance into investment products come at a high cost and long lock-in periods.

Where can you put your hard earned money to get good returns in the capital markets, while paying reasonable fees for managing your funds? The answer will always vary from source to source. Unfortunately, this is often not a case of differing opinions but a result of bias towards the products that the company or source may be associated with. Essentially, the focus of these voices is to sell rather than to impart knowledge or create awareness.

What is then the right answer? And why should you believe us? Because we will back up everything we say with actual numbers so that you can see for yourself. Afterall, the devil is always in the numbers.

Let’s start with what the common types of managed investments are and how we pay for them before we go on to decide upon the best option.

What are the common types of managed investments?

There are three main categories of managed investments that people avail:

Type of investment

Low cost investment

Mid cost investment

High cost investment

Product types

Direct mutual funds and Exchange traded funds (ETFs)

Traditional mutual funds

Investment-linked plans or endowment plans

How to avail

Stock exchange, SEBI certified advisor or robo advisor, directly from mutual fund house

Through a distributor, broker, bank or insurance company

Through an insurance company, bank or agents

Management

Individual funds or ETFs may be actively or passively managed by the fund manager. Overall portfolio managed by your advisor or robo advisor or self managed

Individual funds managed by the fund manager. Distributor or agent can only provide incidental advice

Individual fund and portfolio managed by the fund manager and the insurance company

Charges incurred

Low annual expense ratio (~ 0.2-0.8% of AUM); Potential charges from robo or human advisor (a few thousand rupees of annual fixed fee or ~ 0.3-0.6% of AUM)

Mid to high annual expense ratio (~ 1%-2.5% of AUM), inclusive of commission for the distributor

High annual expense ratio (~ 1.5-2.5% of AUM); additional distribution and other product charges (~ 1-2% annually)

Overall annual cost

0.2%-1.4% (avg 0.8%) of AUM

1%-2.5% (avg 1.75%) of AUM

2.5%-3.5% (avg 3%) of AUM

Which is the best option?

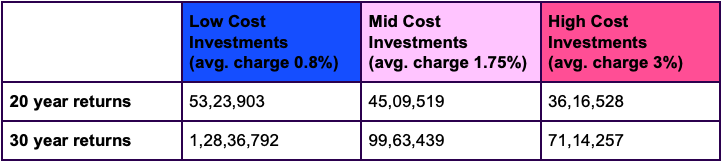

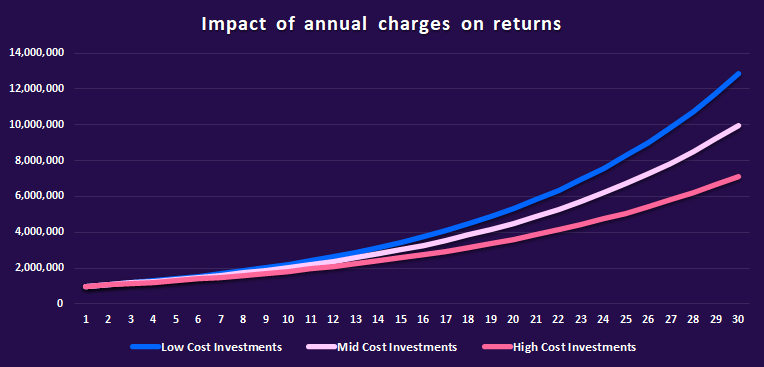

Let us compare an investment of Rs 10,00,000 at a 10% annual rate of return for the purpose of these projections:

As is clear from the projections above, lower costs directly translate to higher returns. The impact gets more pronounced as we look at longer time horizons due to the compounding effect. A difference of 2.2% in annual costs between the high cost and low cost investments leads to a difference of Rs 57,22,535 in returns over a 30 year period. Similarly the 0.95% difference in annual costs between the mid cost investments and the low cost investments leads to a difference of Rs 28,73,353 over a 30 year period.

Based on the numbers, you would be significantly better off choosing the low cost options.

How valid are the arguments supporting mid and high cost investments?

While the projections above demonstrate a clear superiority for low-cost investments, it is important to dissect the counter-arguments used to sell mid and high cost investments before we come to a conclusion.

Arguments for traditional mutual funds (mid-cost investments)

1) You do not pay any upfront commissions

This is a half truth. Although you don’t pay an entry commission, you do pay commissions annually as part of your expense ratio or management fees. These annual commissions can add up to be significant in the long run as we saw from the projections earlier.

2) Traditional mutual fund portfolios are managed whereas direct mutual funds are not

Direct mutual fund portfolios, just like traditional mutual funds will also be managed in most cases, especially if you go with a solution such as a robo advisor. In fact, the robo advisor or SEBI certified human advisor will have more incentives to manage your funds and grow them in the long run as they get compensated only if you stay on with them. This inherently aligns their interest to the benefit of the investor.

Arguments for insurance-based investments (high-cost investments)

1) Your capital is guaranteed no matter what happens to your investments

These capital guarantees only kick-in in the long term, in about 10-15 years. This is where the catch lies. The truth is for any diversified balanced portfolio, irrespective of whether it is insurance-based or not, the probability of your investment value being lower than your original investment amount is almost zero after a 10-15 year holding period. Hence, this capital protection is pretty much meaningless. On the other hand, if you surrender your insurance-based investment before this lock-in period ends, you are guaranteed to lose your capital due to high penalties for early surrender.

2) Your family will get paid a sum assured if something were to happen to you

While this may seem like a great benefit at the face of it, the fees you end up paying for it are very high. You would be better off buying a term insurance that would provide the assured sum at much lesser costs. You can then direct the rest of the capital in other investments to grow your wealth.

Bottom Line

Low cost, pragmatic portfolios consisting of direct mutual funds and ETFs are the best strategy you could use to maximise your returns on investment. Work with an advisor that has a fiduciary responsibility to work in your best interest to ensure you get unbiased advice. In India, this means opting for SEBI-certified human and robo advisors who are the only entities in the country that have their interests aligned with a client doing well by virtue of their compensation structure. Most other so-called advisors are in truth distributors who get paid just to sell you funds. Beware of this distinction when you’re making your investment decisions.