There has been an age old debate about which is better. Different people will give you varying answers depending on their vested interest and level of knowledge. The conflicting views might understandably leave you confused but the answer is easier to arrive at than you might think. All you need to look at are the numbers.

What Is Life Insurance And Term Insurance?

Life Insurance

Life insurance is a contract where the insurance company pays a death benefit if the insured were to pass away in return for regular payments (premiums) made. Most life insurance schemes cover the insured for their whole life, with an option to end the policy earlier in return for the cash value that has accumulated in the policy.

Term Insurance

A term insurance is a kind of life insurance that provides coverage for a certain amount of time or “term”. After the term has been completed, the coverage ceases and no cash value is accumulated. As a result, term insurance premiums are significantly cheaper than life insurance.

Similarities

- Both policies have a guaranteed “death benefit” in case the insured were to pass on.

Differences

- Life insurance premiums are much more expensive as compared to term insurance.

- Life insurance has a surrender value that you get back if you end the plan. However, note that if you were to surrender a life insurance plan in the early years (<20 years), it entails severe penalties which means you often get less than the amount that you paid. On the other hand, term insurance does not offer a surrender value when the plan ceases.

- Most life insurance plans go on for the entire life of the insured while term insurance coverage ceases after the “term” is over. That said, some term insurance plans provide coverage for up to 100 years of age while some others provide the option of renewal after they cease.

Which is better?

ANSWER: Term Insurance

But wait, you might have heard otherwise. “You are getting coverage for your entire life with the life insurance plan!” “You will even get back your cash and more if you decide to surrender your policy!”

So why in the right mind would anyone choose a term insurance plan over a life insurance plan? Let’s deep dive into the numbers.

Cost Comparison

Let’s take the example of Raj, a 30 year old man with a monthly budget of Rs 5,000 to get life coverage for himself. He can spend it in two ways.

Raj would be able to purchase a life insurance plan with a monthly premium of Rs 5,000 which would cover him for Rs 62,50,000. Now, say he surrenders the plan in 20 years at age 50,

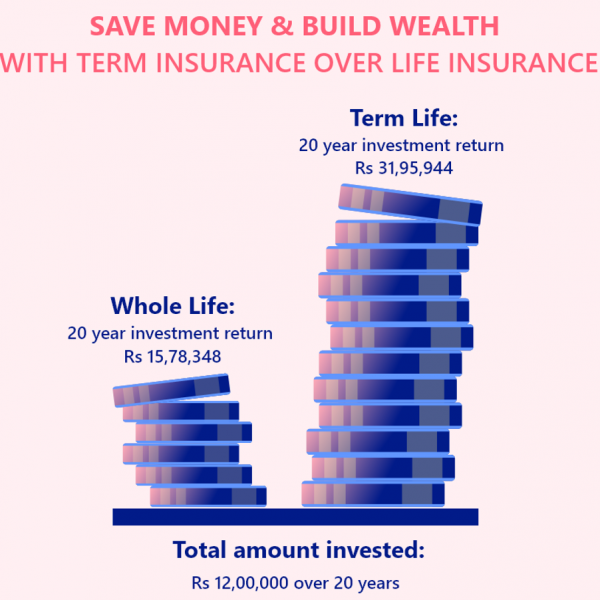

Total amount he has paid = Rs, 12,00,000

Estimated cash value he gets back = Rs 15,78,348

Capital gain = Rs 3,78,348

Alternatively, Raj can purchase a term insurance plan with a 20 year term for the same coverage amount of Rs 62,50,000. His monthly premium would come down to Rs 350. Since he saves Rs 4,650 on his monthly premium, he can now invest this in say a balanced mutual fund or exchange traded fund that gives a 10% rate of return. When he turns 50, his term insurance expires and doesn’t give him any cash value. However, the Rs 4,650 that he invested monthly would have grown. So overall,

Total amount he has spent = Rs 12,00,000 (Rs 84,000 in term insurance, Rs 11,16,000 in investment)

Total return on investment = Rs 31,95,944

Capital gain = Rs 19,95,944

Raj gets Rs 16,17,596 MORE in 20 years by opting for a term insurance and investing the rest of his budget as compared to buying a life insurance. At the same time, term insurance provides the same death benefit as the life insurance plan.

But why is this happening? The answer is simple: charges and more charges. Life insurance plans have a lot of different fees layered into them which eat into the returns given back to you. Some of these usually include commissions, marketing expenses for the product, administrative charges, etc.

What if I need coverage for life?

We need to step back and look at the main purpose for getting life insurance in the first place. Life insurance is to act as a replacement of our income in case we are not around to provide for our loved ones. Hence, we technically only need coverage till our dependents get independent or to protect our income earning years.

Typically it’s recommended to have your term of coverage till retirement age. However, for cases where we might have dependents all our life, there are term insurance schemes which have terms going all the way to age 100. So even in these cases, there is no compelling case for a life insurance plan.

The Bottom Line

Hence, a term plan is the most cost efficient and effective solution to take care of your protection needs, provided that you invest the rest of your funds (which is what you should be doing anyway). Get your term insurance cover as early as possible to reap the benefits of the lower costs.