Key Takeaways

- Automated passive investment management strategies such as dollar cost averaging, periodic rebalancing and glide path can go a long way in mitigating the impact of market volatility on your portfolio.

- Glide path helps reduce volatility of your exit by reducing the exposure to higher risk assets such as stocks over time and increasing the exposure to bonds or cash equivalents.

- This ensures that the target amount saved up for your goal does not get overly exposed to last minute swings in the markets.

Imagine your investment process as an aircraft’s journey. Yes air travel, that beautiful long lost friend that’s been elusive for a while due to COVID-19. There are three key steps that make a good flight – a gentle take-off, a smooth sailing flight and a soft landing. The same principles are applicable to your goal-based investments as well: your point of entry into the investment, managing the investments along the way, and finally the exit point to ensure a smooth finish.

How to activate turbulence protection within your portfolio?

There are a few key strategies that help you neutralise the turbulence that is your market volatility in your investment journey. These can be even more helpful for passive investment management for those who prefer to largely keep their portfolio on autopilot.

The entry point: The strategy of dollar cost averaging suggests that you should purchase the asset you are investing in over a period of time to average out the buying price and reduce the impact of market volatility on your portfolio.

The smooth sailing: A well diversified portfolio allocation can help protect your investment against major swings in any particular asset type or class. Rebalancing your portfolio periodically ensures that this asset allocation and risk level is maintained, keeping the exposure to volatility in check.

The exit point: Glide path – the focus of our article today – is one of the most important strategies to enable a smooth exit, ensuring that you reduce the impact of market volatility on your returns.

What is a glide path?

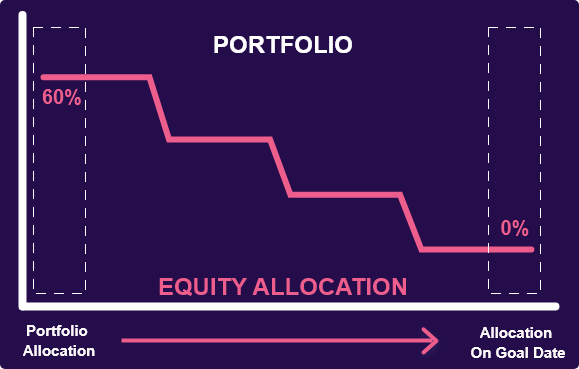

Glide path refers to the gradual change in your asset allocation over a period of time. With a focus on exit, glide path would typically reduce the exposure to higher risk assets like stocks over time and increase the exposure to bonds or cash equivalents. The objective is to reach a low volatility portfolio exposure by the time that you need to exit.

How can glide path be used for goal achievement?

Saving and investing towards your goals is the best way to make sure you reach your goals early. Imagine saving up for your kids’ university education using a balanced portfolio of 60% equity and 40% bond. Let’s say you have 1 year left before you need to withdraw your investment. With glide path, the portfolio allocation will be changed over the last year of the investment with the following transactions:

- Original asset allocation: 60% equity & 40% bond

- Change in allocation 1 year before surrender: 45% equity & 55% bond

- Change in allocation 9 months before surrender: 30% equity & 70% bond

- Change in allocation 6 months before surrender: 15% equity & 85% bond

- Change in allocation 3 months before surrender: 0% equity & 100% bond

Since bonds are considered safer assets than equities, what you are essentially doing is buying into the safer asset to shift your portfolio’s orientation towards lower risk as the date of surrender nears. You are also averaging out the selling price of your riskier assets over a period of time to mitigate the impact of market volatility, similar to dollar cost averaging. This ensures that the target amount that you are building up for your goal through your investments do not get overly exposed to last minute swings in the markets.

What if glide path is not activated?

Imagine a situation without glide path: your equity allocation is still 60% a month before you need to surrender. If in the unfortunate scenario that a market crash happens in that month, without glide path, your portfolio is overexposed to its impact. This is because equity prices typically have much higher price swings as compared to bond prices due to their higher risk return profile. For instance, in the 2008 financial crisis, global equities fell by about 50% whereas global bonds fluctuated by less than 10%.

In a similar crisis, say your equities reduce in value by 40% whereas the impact on bonds is only 10%. Overall your portfolio would fall by 28% due to its over exposure to equities as opposed to 10% with glide path in place. This could be the difference between your ability to meet your goal vs being thrown off-track.

Bottom Line

For the average investor with no time and bandwidth to actively manage their portfolio, automated strategies such as dollar cost averaging, auto fund rebalancing and glide path go a long way in ensuring you can secure good returns at your desired level of risk by mitigating the impact of market volatility on your portfolio. They essentially help you put your investments on autopilot.

We at Cashvisory are building a solution to help you exercise these strategies with ease. Stay tuned!