Balance is one of the most important things in all aspects of life. As the old adage goes, too much of a good thing could be a bad thing. This is especially true in the context of your investment portfolio: too much weightage on any particular fund could leave your portfolio overly exposed to the performance of the fund. This is why it is important to diversify your portfolio when you start investing to ensure it caters to your risk appetite and is not overly susceptible to fluctuations in a single fund.

That’s your first step to investing smart. But how can you maintain your optimal portfolio diversification throughout your journey in line with your risk appetite. The answer is: by rebalancing your portfolio periodically to the original pre-determined diversification levels.

Let’s explore how this strategy works and how it helps us.

What is portfolio rebalancing?

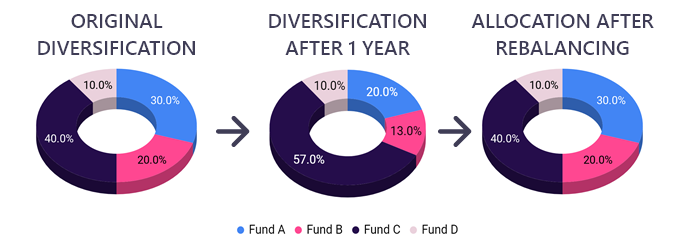

Rebalancing is the process of bringing the asset allocation of your portfolio back to its original optimal diversification levels. It involves selling part of the assets that have increased in weightage in your portfolio and buying more of the assets that have reduced in weightage.

For example, in the situation below, Fund C performed better than the others after the first year, increasing its allocation in the portfolio. What this means is the portfolio is now more susceptible to any fluctuations in Fund C’s value and if the fund were to perform poorly in the future, the overall portfolio would face a larger than desired impact. Rebalancing brings the exposure of the portfolio back to the original allocation in line with the individual’s risk appetite to mitigate this risk.

How does rebalancing help me?

Critics would argue that if a fund is increasing value, buying out of that stock would reduce the overall returns. The underlying faulty assumption here is that the fund will continue to grow at the same rate in perpetuity.

For instance, if you look at Tesla stocks, it is highly volatile going from $185 in May 2019 to $900 in Feb 2020, down again to $425 in Mar 2020. So let’s say you were to build a stock portfolio with 10% exposure to Tesla stock in May 2019. Your exposure to Tesla would go to a whopping 35% in Feb 2020 with the 5-fold increase in its value, assuming rest of your stocks remain relatively stable. This means that your portfolio is now very sensitive to changes in Tesla’s stock price. So the dip in its value in Mar 2020 would have brought your overall portfolio down by 17.5%!

Timing markets is a tricky business and often unpredictable, and while you can gain big, you can lose big as well if you rely too much on one stock or fund. Rebalancing works on the concept of mitigating your risks and maximising your returns. In the above case, if you had rebalanced your portfolio, you would have sold part of Tesla at a high price and bought into the other assets at a relatively lower price. In the process, you would have also resolved the lop-sided exposure within your portfolio.

How does rebalancing help during volatility?

Volatility in the markets is characterised by erratic increases and reduction in asset prices. The current COVID-19 pandemic is a very good case study for such a period. The stocks have been highly volatile and the markets have been fluctuating in either direction with extreme unpredictability. If we try to time the markets during such times, we are more likely to be wrong than right.

During such tumultuous times, disciplined periodic rebalancing is an astute way of capitalising on the unpredictability with the help of the sell high-buy low principal. As one stock goes up, we book the profits from it and put it into assets that are yet to show significant gains. Now when this trend reverses, we are well poised to benefit from the turbulence. Take the guessing game away from your portfolio and focus on maintaining some semblance of balance during times when most other things are unbalanced.

How do I implement rebalancing in my portfolio?

Portfolio rebalancing can be implemented in a few ways, varying in the level of expertise required.

- Periodic rebalancing: As the name suggests, this is executed periodically, the most common intervals being quarterly, six-monthly or annually. Your portfolio is rebalanced to its original diversification levels only at the chosen regular intervals.

- Percentage-of-portfolio rebalancing: In this case, an allowable percentage allocation is defined for each asset class. For example, rebalance if an asset class has swings of more than 5% in either direction. This method keeps your allocation within a specified range at all times.

- Constant-proportion portfolio insurance: A highly advanced method of rebalancing, this strategy aims to maintain a ‘safe reserve’ in the portfolio allocation, which evolves in line with the size of the portfolio. When the overall portfolio size is small, your portfolio is rebalanced such that sufficient amount of funds are in safer assets e.g. bonds, money market instruments. As the portfolio size and net worth increases, a higher risk tolerance can be assumed which means after maintaining a minimum reserve of safe assets, the rest of the portfolio can have higher allocation into riskier assets such as equity.

Bottom Line

Implementing a portfolio rebalancing strategy is one of the easiest ways to passively manage your investments and avoid any major downside risks. In a nutshell, rebalancing helps with:

- Bringing the risk exposure of the portfolio back to your risk tolerance levels.

- Maintaining your ideal diversification levels.

- Selling high and buying low to help you book your returns.

The rebalancing strategy helps put your portfolio on autopilot so that it doesn’t need constant monitoring. These methods can be implemented manually or through automation. We are working on a sophisticated portfolio rebalancing tool to assist you in this process in the coming months. Stay tuned!