Key Takeaways

1. Scope and Focus: Investment planning deals specifically with managing investment portfolios, while financial planning encompasses all areas of personal finance.

2. Objectives: Investment planning aims to optimize resources by using time, money, and energy efficiently to achieve the best results. It’s about prioritizing important tasks and eliminating waste to maximize output. and manage risk for specific financial goals. Financial planning aims for overall financial well-being by aligning financial decisions with personal goals.

3. Evaluation: Investment planning measures performance against benchmarks, whereas financial planning measures progress by achieving personal goals.

4. Risk Management: Investment planning focuses on portfolio resilience to market volatility, while financial planning develops strategies for navigating life changes and uncertainties.

Choosing the Right Strategy: Investment Planning vs. Financial Planning with Cashvisory

Finance often seems complicated and confusing due to its unique vocabulary, acronyms, strategies, and jargon. This can be overwhelming for those not immersed in it daily.

Two commonly heard terms that are sometimes used interchangeably, but actually have distinct meanings, are investment planning and financial planning.

Let’s explore the similarities and differences between these two disciplines.

Investment Planning

Investment planning mainly concentrates on handling investment portfolios to meet financial objectives.

This includes choosing suitable investment options such as stocks, bonds, mutual funds, and alternative investments, as well as making decisions about asset allocation, diversification, and risk management.

What Is Financial Planning?

Financial planning is a more comprehensive process that covers multiple areas of personal finance beyond just investments. It involves collecting relevant information and evaluating an individual’s or household’s entire financial picture, including expenses, assets, liabilities, taxes, insurance needs, retirement planning, and estate planning.

The goal of financial planning is to develop a detailed strategy that aligns financial decisions with personal goals and priorities.

Comparison: Investment planning vs. Financial Planning

While these two disciplines do overlap, there are significant differences between them. Frequently, the advertisements and messages you encounter online or on TV pertain more to investment planning than to financial planning.

| Basis | Investment Planning | Financial Planning |

|---|---|---|

Definition | Focuses on managing and optimizing investments to achieve specific financial goals. | Encompasses a broader range of strategies to ensure overall financial well-being, including investments, budgeting, saving, and future financial needs. |

| Scope | Narrower scope: Primarily deals with the selection, allocation, and management of financial instruments such as stocks, bonds, mutual funds, etc. | Broader scope: Includes all aspects of financial management, such as investment planning, retirement planning, estate planning, tax planning, risk management, and budgeting. |

| Primary Objective | To maximize returns and achieve specific investment goals. | To create a comprehensive plan for achieving overall financial health and security |

| Time Horizon | Often focused on medium to long-term investment horizons. | Includes both short-term and long-term financial planning. |

| Key Activities | Asset allocation, portfolio management, performance monitoring, and risk assessment of investments. | Goal setting, cash flow management, retirement planning, insurance planning, tax strategies, estate planning, and investment planning. |

| Decision Making | More focused on selecting appropriate investment vehicles and strategies to grow wealth. | Involves decision-making across various financial domains to ensure balanced and sustainable financial health. |

| Tools and Instruments | Stocks, bonds, mutual funds, ETFs, real estate, commodities, etc. | Comprehensive financial tools and strategies, including budgeting tools, retirement calculators, insurance products, estate planning documents, and investment portfolios. |

| Advisory Services | Investment advisors or portfolio managers specialize in providing investment planning services. | Financial planners or certified financial advisors offer holistic advice that includes all aspects of financial well-being. |

| Risk Management | Primarily concerned with investment risks such as market risk, credit risk, and liquidity risk. | Broader risk management, including insurance coverage, emergency funds, and strategies to mitigate various financial risks. |

| Holistic Approach | Focuses mainly on growing and protecting investment portfolios | Takes a holistic view of the investor’s financial life, ensuring that all financial aspects work together to support overall goals. |

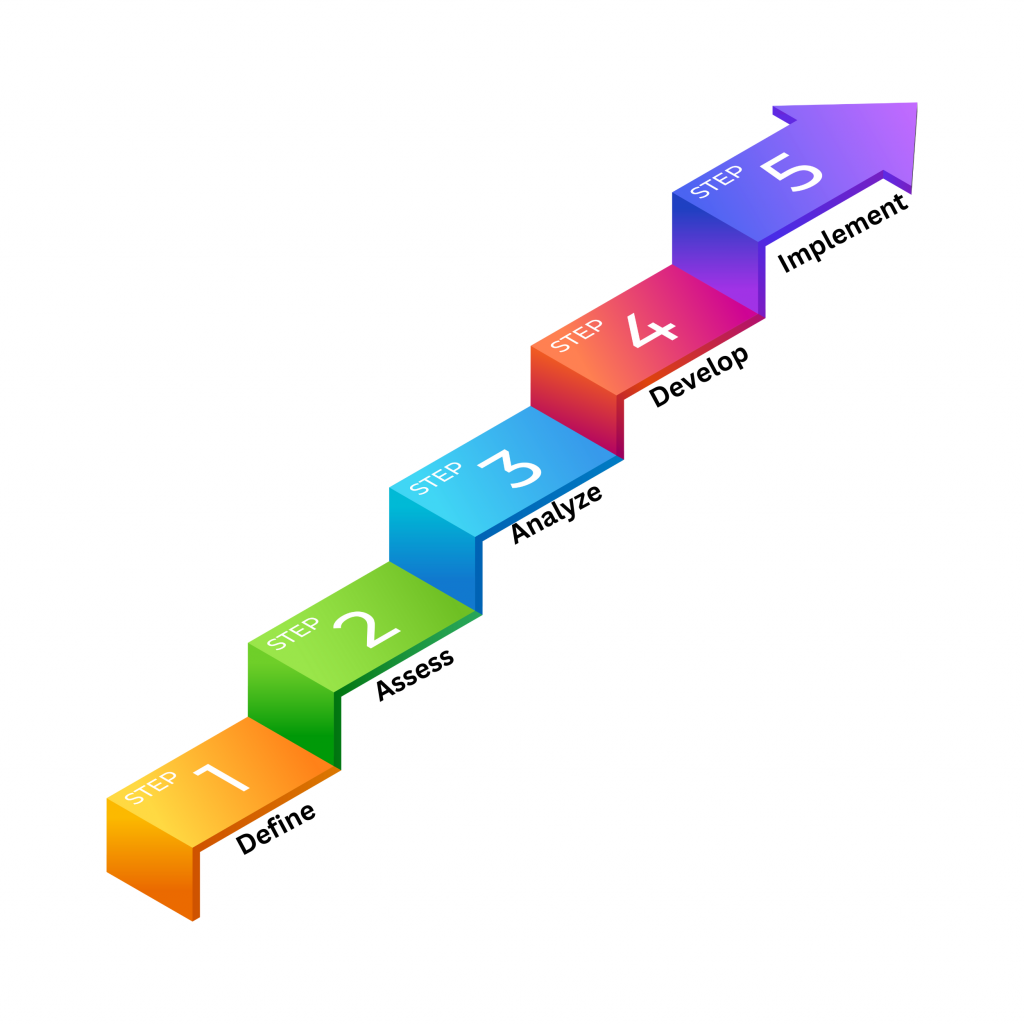

Steps to Secure Your Financial Future Through Financial Planning

Financial planning is essential for maximizing your assets and safeguarding you and your family against financial setbacks. A well-structured financial plan involves several key steps to ensure your financial stability and growth. Here’s a breakdown of the process:

Step 1: Define Your Financial Goals

The first step is to discuss your financial objectives and goals with a financial advisor. This discussion helps create a personalized roadmap for your financial future, tailored to your specific needs and aspirations.

Step 2: Assess Your Current Financial Situation

Your financial advisor will collect all relevant financial information, including your assets, liabilities, income, expenditures, and risk tolerance. They will generate a detailed report outlining your current financial profile, highlighting your strengths and weaknesses through key metrics like the solvency ratio, savings ratio, and liquidity rate.

Step 3: Analyze Your Financial Data

The financial advisor will review and analyze the information you have provided. This analysis helps in understanding your financial standing and identifying areas that need improvement.

Step 4: Develop and Present Your Financial Plan

Based on the gathered information and analysis, your financial advisor will develop and present a comprehensive financial plan. This plan includes detailed elements such as annual consolidated tax calculations, a net worth statement, and an annual cash flow report.

Step 5: Implement Recommendations

After reviewing the financial plan, your advisor will suggest actionable steps to achieve your financial goals. These recommendations may include specific investment strategies, adjustments to income and expenditure, and other financial decisions.

By following these steps, financial planning helps you feel more confident and prepared in times of economic uncertainty, such as recessions or inflation. It ensures that you are making the most of your assets and are protected against potential financial challenges, securing a stable future for you and your family.

How Does Investment Planning Work?

Creating an investment plan requires thorough research and careful consideration. Here’s a step-by-step guide to help you understand the process:

Step 1: Assess Your Current Financial Situation

Begin by discussing your current financial status with your investment advisor. This includes setting a budget based on your willingness to invest, emergency savings, and income after expenses.

Step 2: Define Your Financial Goals

Next, clearly outline your financial goals and an estimated timeline. Specify the growth you expect from investing a certain amount over a given period.

Step 3: Determine Your Risk Tolerance

Your advisor will help you assess your risk tolerance, which is the level of risk you are comfortable taking to achieve potential growth. Additionally, discuss your time horizon, indicating when you plan to withdraw your investments to meet your financial objectives.

Step 4: Choose Your Investments

Decide where you want to invest your money. Based on your financial profile, your advisor will recommend the best investment options, whether in bonds, stocks, or other assets.

Step 5: Monitor and Rebalance Your Investments

Finally, your investment advisor will continually monitor the performance of your investments and rebalance your portfolio as needed to help you reach your goals more efficiently.

While financial planning provides a comprehensive overview of your finances, investment planning is a crucial component that focuses on growing your wealth. Effective investment planning helps you achieve financial freedom, allowing you to navigate the many twists and turns life may present. By following these steps, you can create a robust investment plan that aligns with your financial goals and risk tolerance, ensuring a secure and prosperous future.

How Cashvisory Enhances Financial Planning and Investment Planning

Financial Planning:

Cashvisory provides a comprehensive platform designed to automate and simplify financial planning, making it accessible and efficient for everyone. Here’s how it works:

1. Budgeting: The platform helps you track your income and expenses, ensuring you live within your means and save for future goals.

2. Saving: By analyzing your spending patterns, Cashvisory suggests ways to save more effectively.

3. Debt Management: It provides strategies for paying off debts faster and reducing interest payments.

4. Insurance: Cashvisory assesses your insurance needs and suggests appropriate coverage to protect you and your family.

5. Tax Planning: The platform offers tips on tax-efficient investments and strategies to minimize your tax liability.

6. Retirement Planning: It helps you plan for a comfortable retirement by setting savings goals and selecting suitable retirement accounts.

7. Estate Planning: Cashvisory guides you through the process of creating a will and planning your estate to ensure your assets are distributed according to your wishes.

By using smart algorithms, Cashvisory delivers personalized advice tailored to your unique financial situation and goals, ensuring a comprehensive approach to managing your finances.

Investment Planning:

Cashvisory also excels in simplifying investment planning. Here’s what it offers:

1. Portfolio Management: The platform provides tools to manage your investment portfolio efficiently.

2. Investment Selection: It helps you choose the right investments based on your risk tolerance and financial goals.

3. Asset Allocation: Cashvisory optimizes the mix of stocks, bonds, and other assets in your portfolio to balance risk and return.

4. Risk Management: The platform continuously monitors your investments, making adjustments to keep your portfolio aligned with your objectives.

5. Market Volatility: Cashvisory’s algorithm-based approach ensures your investments are resilient against market fluctuations, promoting steady growth.

What Services Does Cashvisory Offer?

Cashvisory provides automated financial planning, investment management, insurance advice, loan management, tax planning, and expense tracking through its smart algorithm-based platform.

How Does Cashvisory’s Platform Benefit Users?

The platform simplifies financial planning by offering automated, personalized advice and decision-making tools, making it easier for users to manage their finances and achieve their financial goals.

Conclusion

In summary, investment planning concentrates on overseeing investment portfolios, while financial planning encompasses a wider array of financial aspects to support individuals or households in reaching their financial objectives. Though distinct, these disciplines frequently intersect, with investment planning serving as a crucial element within the broader framework of financial planning.

Cashvisory is here to support you as you work to achieve your financial planning goals.