Introduction

Let’s face it, life throws curveballs. One of the biggest ones can be a sudden health crisis. Not only does it disrupt your life, but it can also hit you hard financially. Medical bills can pile up faster than you can say ‘ouch’! That’s where health insurance planning comes in. While the obvious benefit of a health insurance plan is to have good medical care when needed, there’s an additional benefit as well – tax savings!

And a crucial part of that plan is understanding how you can save on your taxes while paying for your health insurance premiums.

One way to do this is by taking advantage of tax deductions. And today, we’re diving into one of the most beneficial ones: Section 80D.

What is Section 80D of the Income Tax Act?

Section 80D is a provision in the Income Tax Act that allows you to claim deductions on expenses related to healthcare.

Think of it this way: Rising medical health costs can seriously impact your financial life if you do not plan for such unexpected expenses. Medical insurance is a safety net to absorb these shocks. But let’s be real, premiums can dig a hole in your pocket.

That’s where Section 80D comes in. It’s the government’s way of saying, “Hey, we appreciate you taking care of your health. Let’s help you out a bit.”

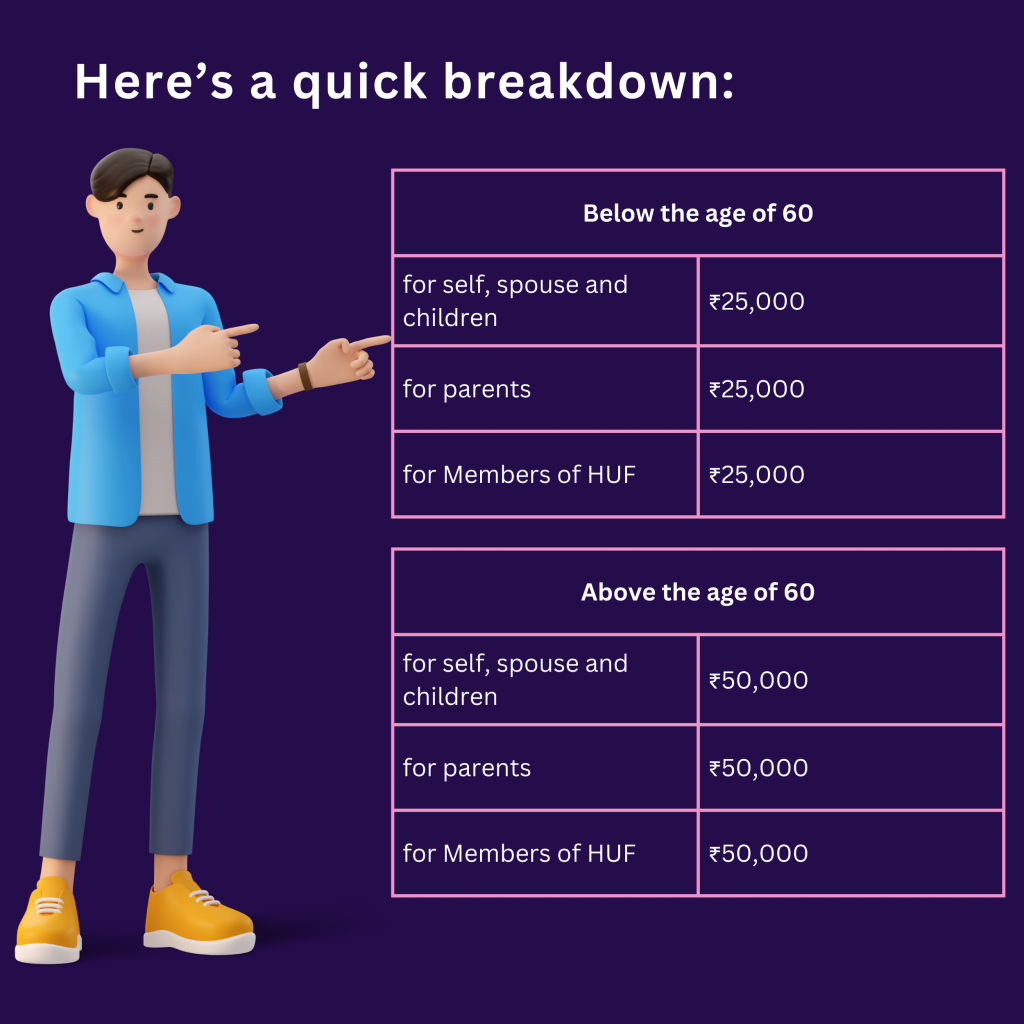

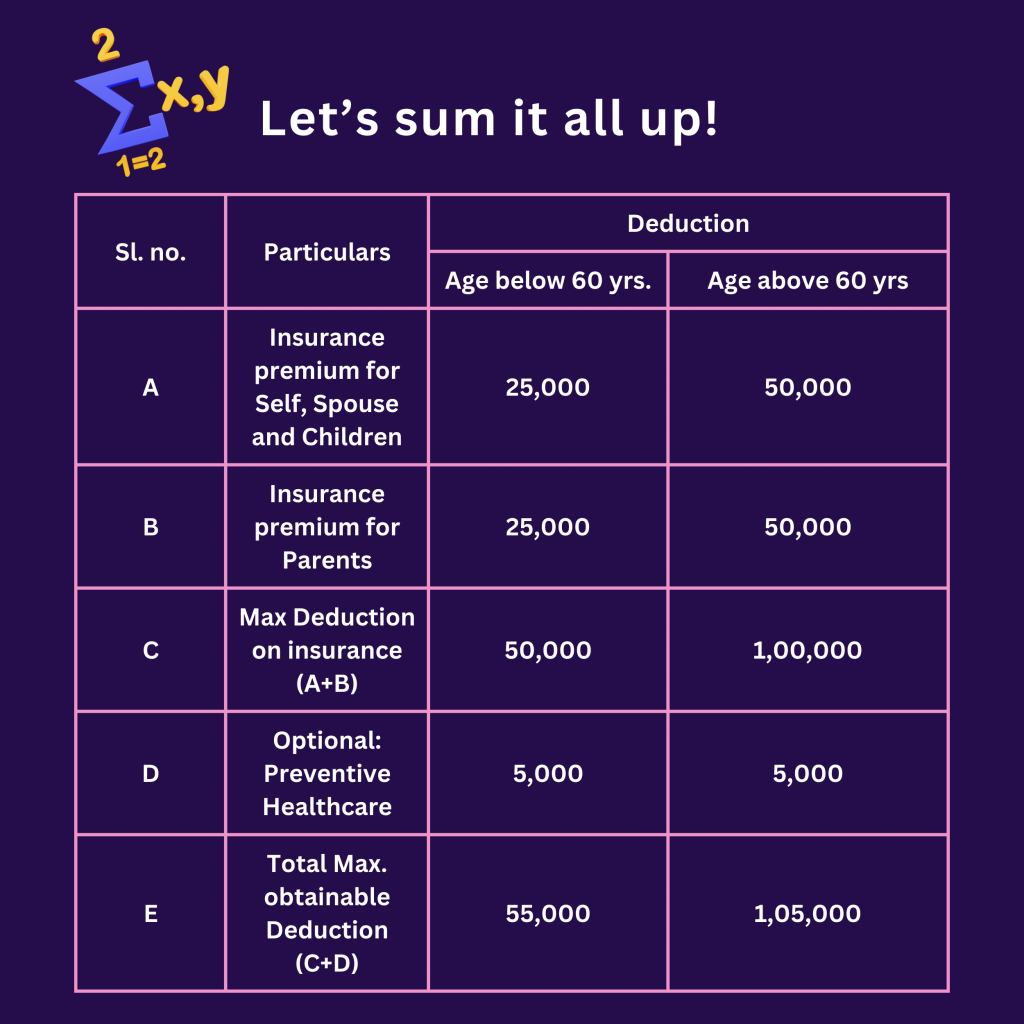

Section 80D of the Income Tax Act offers tax deductions to individuals and HUFs of up to Rs. 25,000 for the premiums paid on health insurance in a particular financial year. But wait, there’s more! For senior citizens (60 years and above), this limit is even higher at Rs. 50,000.

And the cherry on top?

You can claim up to Rs. 1 lakh in total deductions under Section 80D.

So, in simple terms, you can enjoy tax benefits on health insurance policies for yourself, your spouse, parents, and dependent children.

Who Is Eligible for Tax Deduction Under Section 80D?

So, you know that Section 80D can save you money on your taxes. But who exactly can take advantage of this? Let’s break it down.

You’re in luck if you’re an individual taxpayer. That means you can claim this deduction for yourself. And guess what? If you’re part of a Hindu Undivided Family (HUF), your family can benefit too.

Now, let’s talk about family coverage. You can claim deductions for health insurance policies covering yourself, your spouse, your dependent children, and even your parents. It’s like a big family healthcare umbrella!

What Are the Exclusions under Section 80D?

- Cash payments: Premiums paid in cash are not eligible for deductions. Use digital methods or checks.

- Missed payments: If you miss a premium payment during the year, you can’t claim a deduction for that year.

- Employer-paid premiums: If your employer covers you, you can’t claim a deduction for the premiums they pay.

- Family members: Deductions are only for premiums paid for yourself, your spouse, dependent children, and parents.

Make sure you understand these exclusions to avoid claiming ineligible deductions.

How much deduction can you avail?

Almost any health insurance plan qualifies for the Section 80D deduction. This includes those extra covers like critical illness riders that you can add to your life insurance policy.

But there’s a limit to how much you can claim. The total maximum deduction is Rs. 1 lakh. However, this amount can change based on your age and who you’re covering.

However, for people over the age of 80, health insurance is usually not available. So in order to give such citizens some tax relief on medical expenses the government has allowed deduction of upto ₹50,000 for expenses on health treatment rather than on health insurance premium.

Preventive Check-Ups and Section 80D

Imagine this: You’re feeling fine, but a simple check-up reveals a potential health issue early on. That’s the power of preventive healthcare. Not only does it help you stay healthy, but it can also save you a ton of money in the long run.

The government knows this too, and they want to encourage regular check-ups. That’s why they’ve included a special perk under Section 80D for preventive health check-ups.

You can claim up to Rs. 5,000 as a deduction for the cost of your check-ups. This includes check-ups for yourself, your spouse, parents, and dependent children.

But remember, there’s a catch. This Rs. 5,000 is part of the overall Rs. 1 lakh limit for Section 80D deductions. So, it’s like budgeting your tax savings – you need to choose where to spend it wisely.

Here’s the nitty gritties detailing the claim on preventive health check-up:

Inclusion in Section 80D: It is important to recognize that this deduction falls within the overall limit set under Section 80D, which is ₹ 25,000 for individuals and ₹ 50,000 for senior citizens. Therefore, the total deduction, including amounts spent on preventive health check-ups, must not exceed these limits.

Frequency and Limits: Preventive health check-ups are eligible for deduction on a per financial year basis. Taxpayers can claim a deduction of up to ₹ 5,000 for preventive health check-ups conducted during the financial year.

Approved Institutions: One should get their check up done from approved institutions and hospitals, to qualify for deductions.

Let’s sum it all up!

Conclusion

So, there you have it. Section 80D is your secret weapon against a hefty tax bill by using those medical bills and insurance to your advantage. By understanding how it works, you can significantly boost your savings. Remember, it’s not just about claiming deductions; it’s about planning for a healthier financial future.

Think of Section 80D as a safety net for your health and your wallet. It’s a small step in your overall financial planning, but it can make a big difference.

We’ve covered the basics, but there’s always more to learn. Keep exploring, ask questions, and don’t hesitate to consult with a tax professional. Your future self will thank you for it.