Key takeaways:

- Mutual funds spread your investment across various stocks and bonds, reducing risk.

- You can invest small amounts in mutual funds, unlike buying individual stocks.

- Professional fund managers manage mutual funds, so you don’t need to be an investment expert.

- Most mutual funds allow you to easily buy or sell your investment (high liquidity).

- There are different types of mutual funds to suit your risk tolerance and investment goals.

- Mutual funds can be a good option for new investors because of affordability and professional management.

- Even with some limitations on accessing your money in certain types of mutual funds, they generally offer flexibility.

Introduction

Have you ever dreamt of turning your spare change into a treasure chest? Maybe you’ve stashed some cash away and you’re wondering how to make it grow beyond the measly interest rate in your savings account. Well, guess what? There’s a powerful tool called a mutual fund that can help you do just that!

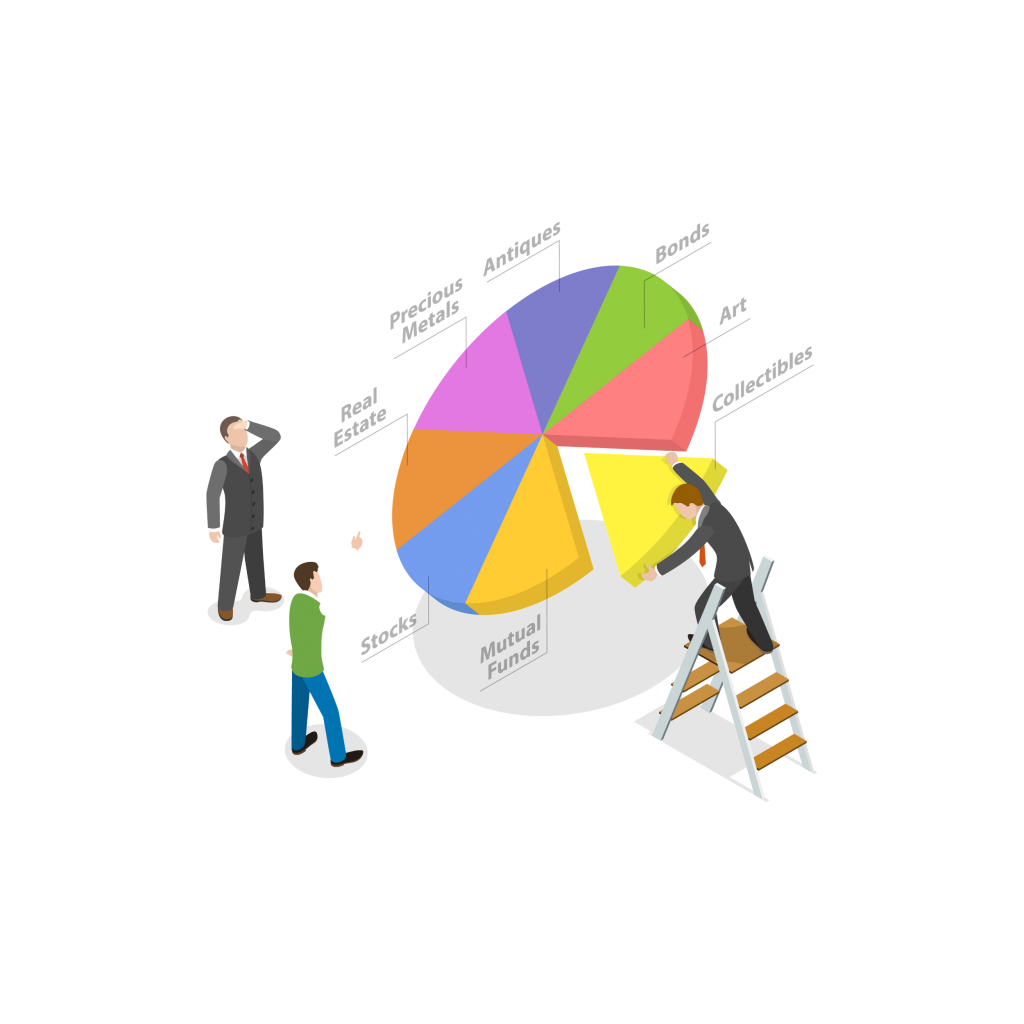

Think of it as a magic money pot that pools your savings with others, and a financial expert does the investing for you, spreading your money across a variety of investments. Mutual funds pool money from investors to buy a variety of stocks, bonds, or both.

This spreads your risk. They’re professionally managed, so you don’t need to be a stock whiz. You can start small and invest regularly, making them a good option for new investors.

Let’s understand the reasons to invest in mutual funds in detail:

1. Spreading Investments, Minimizing Risk (Diversification)

Mutual funds don’t just invest in roses, they buy a whole bouquet! They pick stocks from different companies and industries.

One of the biggest benefits of mutual funds is risk diversification which is the spreading of investments in multiple securities and asset classes.

So, if one company or industry dips, the others can help balance things out. This reduces the impact of bad news on any single company (called company risk).

There are primarily 2 types of risks when it comes to investments. Firstly, company risk affects the company and industry specifically. Then, there are market risks, which affect all companies to some degree. By diversifying, mutual funds help you mostly avoid company risks, leaving you to manage just the overall market risk.

2. Less Capital Intensive

Another advantage of mutual funds is that you can start investing in mutual funds with relatively small amounts.

Building a strong investment portfolio by buying stocks directly can be expensive. You may need a lot of money upfront to buy shares, especially some blue chip companies, for example, a single stock of MRF tires costs upwards of ₹1 lac.

Mutual funds take away this barrier. Since they pool money from many investors, you can benefit from a diversified portfolio of stocks with a much smaller investment.

This means you can start investing with as little as Rs 10! It’s like buying a tiny slice of a giant pizza instead of buying the entire pizza.

3. Experts Manage Your Money

Investing in stocks and bonds requires considerable expertise and experience. You need to have knowledge of financial markets, industry sectors, individual companies and research expertise.

Mutual funds are like having a personal investment team. Mutual funds are run by fund managers who’ve spent years studying the market. They pick stocks, bonds, or other investments aimed at getting you the best returns while managing risk.

They’re backed by the whole research team at the mutual fund companies, digging deep to find the best opportunities. So you can relax, knowing your money is in the hands of professionals.

4. Higher Liquidity than traditional investments

One of the great things about mutual funds is their liquidity, meaning you can get your money out when you need it.

Most mutual funds (called open-ended funds) let you buy or sell shares on any business day. The price is based on the fund’s daily value (Net Asset Value- NAV), so you have flexibility.

Some mutual funds, like tax-saving schemes (ELSS), have a lock-in period, typically 3 years. This means your money is temporarily unavailable, but it comes with tax benefits.

5. Choose funds suiting your risk tolerance

With over 2,000 options, there’s a fund out there for everyone, no matter your risk tolerance, goals, or investment timeline.

Debt funds invest in bonds for steady income, equity funds aim for growth by buying company shares, and hybrid funds mix both. Debt funds offer the lowest risk, ideal for those seeking stability.

Balanced or hybrid funds combine stocks and bonds for moderate risk. Equity funds offer the highest potential returns but also come with the most ups and downs.

Long-term goals are a good match for equity funds, whereas if you want to take your money out in the near future Debt funds and balanced funds might be a better fit.

Conclusion

Now that you’ve unlocked the secrets of mutual funds, it’s time to take action! With their diversification, affordability, professional management, and flexibility, mutual funds offer a powerful tool to grow your wealth and achieve your financial goals.

Remember, even small, regular investments can blossom into something big over time. Whether you’re saving for a dream vacation, a child’s education, or a comfortable retirement, there’s a fund designed to help you reach your target.

Talk to a financial advisor to explore which mutual funds best suit your risk tolerance and investment horizon. Remember, the potential for higher returns often comes with more risk. So, take expert guidance from a SEBI registered advisor like Cashvisory to help you navigate your mutual fund investments for maximum benefit.

Let’s turn your spare change into a treasure chest, together!

BONUS

Top Funds:

Top LargeCap funds:

ICICI Prudential Bluechip Fund; Canara Robeco Bluechip Equity Fund; Kotak Bluechip Fund

Top MidCap Funds:

Quant Mid Cap Fund; Mahindra Manulife Mid Cap Fund; Kotak Emerging Equity Fund

Top SmallCap Funds:

Quant Small Cap Fund; Tata Small Cap Fund; Canara Robeco Small Cap Fund

Top FlexiCap Funds:

Parag Parikh Flexi Cap Fund; Union Flexi Cap Fund; Quant Flexi Cap Fund