Remember that wide-eyed wonder on your child’s face when they declared they wanted to be an astronaut, a veterinarian, or maybe even the inventor of the world’s fluffiest pancake? Those dreams, fueled by pure imagination, are the seeds of a bright future.

The ever-rising cost of education can leave even the most financially responsible parents feeling a touch of panic. It’s like trying to fill a swimming pool with a leaky bucket – one filled with tuition hikes and living expenses, and inflation being the leak draining your wealth away.

But what if there was a secret weapon you could use to turn that leaky bucket into a mighty dream fulfilling financial pump?

1. The Magic of Compound Interest (Time is Your Ally!)

The reality is, educational costs are on a rocket ship, soaring past inflation. While everyday expenses might rise by 5-6% a year, the cost of higher education in India is inflating at a staggering 11-12%! Factor in hostel fees, books, and living expenses, and that pool we’re trying to fill feels more like an ocean.

But here’s the good news: there’s a superhero in the world of finance called compound interest, and the secret weapon is time. It’s like a magic money-growing machine that rewards you for starting early. The more time your money has to grow, the faster it multiplies – like a snowball rolling downhill, gathering momentum with every spin.

2. Choosing the Right Investment Vehicle (Find Your Investment Chariot!)

So, we’ve identified the leaky bucket and discovered the magic money-growing machine of compound interest. Now, it’s time to choose the right vehicle to carry your investments towards your child’s educational dream.

Imagine you’re on a road trip to that dream college. Fixed deposits are like a trusty old bicycle – reliable, but slow and limited in how far you can travel. Education-focused insurance plans might seem comfortable, like a taxi with a set route, but they often come with restrictions and limited growth potential. These plans typically offer around 5% returns after tax, which often struggles to keep pace with inflation. Imagine trying to fill the pool while it simultaneously drains at a faster rate!

So, we’ve identified the leaky bucket and discovered the magic money-growing machine of compound interest. Now, it’s time to choose the right vehicle to carry your investments towards your child’s educational dream.

Imagine you’re on a road trip to that dream college. Fixed deposits are like a rusty old bicycle – reliable, but slow and limited in how far you can travel. Education-focused insurance plans might seem comfortable, like a taxi with a set route, but they often come with restrictions and limited growth potential. These plans typically offer around 5% returns after tax, which often struggles to keep pace with inflation. Imagine trying to fill the pool while it simultaneously drains at a faster rate!

For a journey filled with possibilities, a well-diversified mutual fund portfolio could be your ideal chariot. Mutual funds pool your money with others and invest it in a basket of stocks and bonds, offering the potential for higher returns – think 12-15% on average over the long term. This can significantly outpace inflation and keep your college fund on track for liftoff.

Now, the road to investing success isn’t always a straight shot. That’s why seeking guidance from a SEBI-registered investment advisor is like having a skilled navigator by your side. They can help you choose the right mix of funds based on your risk tolerance and time horizon, ensuring your investment journey is smooth and reaches the desired destination – your child’s bright future.

3. Building a Sustainable Investing Plan (Your Investment Roadmap)

Imagine you’ve chosen your dream chariot – a well-diversified mutual fund portfolio. But before launching your investment journey, a quick pit stop is needed. Here’s what to consider:

- Cost Check: University in India or abroad? Postgraduate dreams? Factor in living arrangements, institution type, and inflation (add 8-10% buffer).

- Time Horizon: How many years until college? The earlier you start, the more your money grows thanks to compound interest (think snowball!).

- Financial Fitness: Review your income and expenses to identify investment surplus. The goal is not to raid other financial goals (like retirement) for college funds.

4. The Power of Small Steps: A Real-Life Example

Okay, let’s get down to brass tacks – how much does it really take to build a sizable college fund? The answer might surprise you – it’s all about starting small and staying consistent. Imagine this:

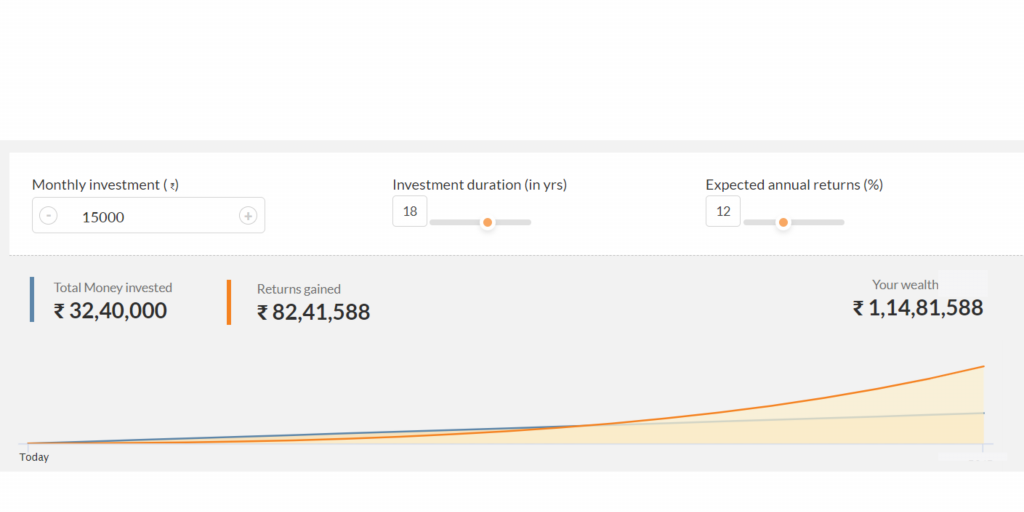

You decide to invest ₹15,000 every month in a diversified mutual fund portfolio starting from the day your child is born. And by the time they are 18 years old, the investment will be 1 CRORE.

Let’s break it down:

- Total Investment: ₹32,40,000 (This is the total amount you would have invested over 18 years)

- Assumed Return: 12% per year (This represents the average annual growth your investment might experience)

- Estimated Returns: ₹82,41,589 (This translates to a whopping 254.4% return on investment, thanks to the magic of compound interest!)

- Total Value: ₹1,14,81,589 (This is the final amount you’d have accumulated)

Important Note: Remember, inflation is a sneaky villain that can erode the purchasing power of your money. While the ₹1 crore might seem like a mountain of money today, its actual value in 18 years might be closer to ₹40 lakhs due to inflation. However, this is still a significant sum that can comfortably cover a large portion of your child’s college education in India, and even a significant percentage of courses abroad!

5. Investing Doesn’t Have to Be Scary! (Busting Investment Myths)

Feeling a little overwhelmed by all this talk of investment plans and financial roadmaps? It’s normal! Investing can seem like a complex maze, but the truth is, it can be surprisingly simple. Think of it like building a sandcastle on the beach – you start with a small pile of sand, one grain at a time, and with consistency, it grows into something magnificent.

The key is to debunk the myths – you don’t need a fortune to start, and there’s a whole team of experts (like Cashvisory, a SEBI-registered advisor) ready to be your guide and help you build a plan strong enough to withstand any financial tide.

Are You Choosing the Right Investments for Your Child’s Education?

Planning your child’s education requires smart financial decisions. In this video, Rinie Gupta from The Modern Indian Parent and Utkarsh Choudhary, CEO of Cashvisory break down the essentials:

Now every time your child looks at you brimming with dreams for their future, you know your right financial moves can make their dreams possible. Investing early is like planting a seed for those dreams – with careful planning and consistent effort, you can watch it blossom into the reality of a secure and fulfilling education.

We’ve explored the magic of compound interest, your investment chariot (mutual funds!), and even built a roadmap to navigate your financial journey. We’ve also debunked the myth that investing is scary – it’s simply about taking that first step, grain of sand by grain of sand.

Here’s the exciting part: You don’t have to do this alone. At Cashvisory, our AI driven financial planning approach coupled with expert assistance from SEBI-Registered advisors help families unlock the power of early investment and achieve their goals. Think of us as your friendly neighborhood financial sherpa, ready to guide you on your path to educational success for your child.

Don’t let your child’s dreams get lost in a sea of financial uncertainty. Book a free call with Cashvisory today and let’s build a plan that turns those dreams into a bright and beautiful reality!