Key Takeaways

- Mutual funds and ETFs are both collections of a basket of underlying assets (usually stocks and bonds) which enables multiple investors to pool their funds and invest in the underlying assets.

- Mutual funds are actively managed and as a result have higher expense ratios. ETFs are passively managed and end up being cheaper.

- Although more people are jumping on the passive investing train, the answer is still not clear cut.

- Diversify your portfolio between ETFs and Mutual funds to reap the benefits of and hedge against the risks of both.

Mutual funds and exchange traded funds (ETFs) have changed the game for most retail investors when it comes to investments in the capital markets. These instruments have equipped people with the ability to create diversified portfolios and optimise their risks and returns, even with small investment amounts. It has also reduced the effort that they would alternatively need to put in to manually pick out and manage stocks. While mutual funds and ETFs both render these benefits, mutual funds are actively managed whereas ETFs are passively managed. Therein lies the source of contention and the debate on which is better.

Now, the debate between active and passive investing has become increasingly polarising in recent years, as is the trend with most debates in the world right now. “90% of active fund managers of mutual funds do not outperform market indexes such as the S&P 500 or the BSE SENSEX” is often the statistics quoted by passive investing proponents to back up their support of ETFs which tracks market indexes. However, proponents of active investing have concerns around how over-concentration of funds into the largest, most popular stocks in the world by virtue of passive investing will give rise to bubbles and increase volatility over the long term. There is some truth to both of these arguments but it’s difficult to pass judgement right off the bat. In this post, we explore the validity and applicability of these claims to determine which is the better investment instrument.

What are the similarities between mutual funds and ETFs?

Mutual funds and ETFs both consist of a basket of underlying assets (usually stocks and bonds), which enables multiple investors to pool their funds and invest in the underlying assets. Both mutual funds and ETFs are less risky when compared to individual stocks and bonds. This is because pooling the assets together takes away some of the unsystematic risks due to diversification.

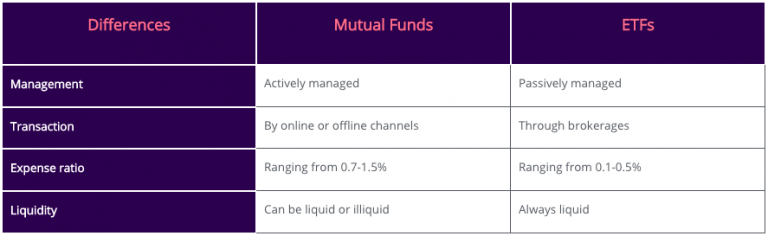

What are the differences between Mutual funds and ETFs?

Given below are some of the key differences between mutual funds and ETFs.

Differences

Mutual Funds

ETFs

Management

Actively managed

Passively managed

Transaction

By online or offline channels

Through brokerages

Expense ratio

Ranging from 0.7-1.5%

Ranging from 0.1-0.5%

Liquidity

Can be liquid or illiquid

Always liquid

Are active fund managers losing out to index funds in all aspects?

No, it is important to view this statement in context. The assertion that most active fund managers are unable to outperform the market indexes is based on research conducted primarily in the US. This is one of the key flaws in this blanket statement, and it especially does not hold water in emerging economies where market indexes are still evolving. Active fund managers can capitalise during such phases of index evolution to outperform the market.

Another point worth noting is that the comparison between such returns are typically done on a short term basis such as yearly or quarterly returns. However, some of the most successful fund managers such as Warren Buffet have actually built their fortunes on producing strong returns in the long run. They pick financially healthy companies with good products and back them to grow without being bogged down by short term fluctuations.

Is passive investing a bubble?

Another hasty generalisation, without sufficient merit. Proponents of this claim hypothesise that passive investors continue to invest in certain high growth funds, resulting in most of the investments being pooled into a few companies such as blue chip technology companies. However, this argument will not hold good in most cases as ETFs, which follow general market indexes, contain companies from a wide variety of sectors. In fact, certain global ETFs also diversify among the different regions of the world. Passive investing in such well-diversified ETFs would not give rise to scenarios resembling bubbles.

What is the verdict?

ETFs have been a game-changer, providing a lower-cost investment solution with similar, if not better, returns than mutual funds. At the same time, the availability of direct mutual fund solutions have led to a reduction in their cost in recent times as well. While still more expensive than ETFs, active management can be beneficial especially during periods of economic downturns.

So should you forgo one for the other? No. Just like all things investment, diversification is key. Don’t put your eggs in one basket and have a portfolio consisting of both ETFs and mutual funds. That way, in instances where active fund managers can’t outperform the market, at least the half of your portfolio which is ETFs and follows the market, will reap the rewards. At the same time, the mutual funds half of your portfolio will be better-cushioned from economic volatility by virtue of active management. Essentially, the mix will allow you to maximise your returns and minimise your risks.

Bottom Line

ETFs and mutual funds have both revolutionised the retail investment market by helping the average Joe reap the benefits of diversified investing with a portfolio of any size. Embrace both of these powerful tools to build out a diversified portfolio and grow your wealth.

When deciding on which ETFs and mutual funds to invest in, it is also important to be cognizant of the fees that you are paying but don’t be overly obsessed on availing the cheapest solution. As we shared in our article on expense ratio, there are other factors such as actual performance, and portfolio building and management strategies that must be considered when making the final call.

We will be coming up with a tool to help you in your investment journey over the coming months. Stay tuned.